NOTES ON STATEMENT 000 – GENERAL PRINCIPLES AND THE GENERIC SCORECARD

Transitional Period

The amendments to Statement 000 are effective from 1 December 2019 (6 months from, the date of the Gazette).

Substance over legal form

In terms of the general principles, the fundamental principle for measuring B-BBEE Compliance remains that substance takes precedence over legal form.

Joint Ventures

The amendment to this statement refers specifically to the inclusion of the principles in respect of the eligibility of joint ventures and start-up enterprises.

In terms of this statement, Unincorporated Joint Ventures are required to compile a consolidated verification certificate weighted per joint venture partner’s proportionate share in the joint venture.

B-BBEE Generic Scorecard

The Generic Scorecard remains unchanged as follows:

The B-BBEE Recognition Levels

The Generic Scorecard remains unchanged as follows:

NOTES ON STATEMENT 300 – SKILLS DEVELOPMENT (SD)

The Dti has issued a further change to the Amended Code Series 300, Statement 300. This amendment is in response to the public demonstrations seen in the Fees Must Fall Movement and Government’s commitment to provide free Higher Education in the country.

This includes the splitting of the targeted leviable payroll spend of 6% per annum to 2.5% for Bursaries for Black students at Higher Education Institutions and 3.5% for spend on Black people (including unemployed people and learners).

The amendments to Statement 300 are effective from 1 December 2019 (6 months from, the date of the Gazette).

The Key Measurement Principles in respect of SD are as follows:

- Priority Indicator - SD remains a priority indicator with a requirement for at least 8 points to be earned (excluding bonus points) in order for a measured entity to avoid being discounted on its overall scorecard;

- Work Place Skills Plan Annual Training Report and Pivotal Reports - Must be in place and approved by relevant SETA for the measured entity;

- Skills Development Spend on learning programmes for Black People – includes external training expenditure for unemployment Black people;

- A measured entity cannot double count Skills Development Spend on learning programmes for Black People and Skills Development Expenditure on Bursaries for Black Students at Higher Education Institutions;

- A Trainee Tracking Tool must be in place for a measured entity to earn any bonus points for absorption;

- Category F and G (Informal Training) cannot account for more than 25% of the total value of Skills Development expenditure;

- Overhead costs on training (accommodation, catering, travelling and costs of SDFs) cannot account for more than 15% of the total value of Skills Development expenditure,

- Overhead costs on skills development expenditure on bursaries for Black Students at Higher Education Institutions can be accounted for at 100% of the expenditure provided that the bursaries or scholarships are grants and are not recoverable. The following conditions on educational grants are allowable:

- Obligation for student to successfully complete their studies within a stipulated time period, and

- Obligation for employment of the student by the measured entity for a period that does not exceed the period of study on successful completion of their studies.

- Mandatory Sectoral Training, e.g. Health and Safety Training in the Construction Sector does not constitute valid skills development expenditure.

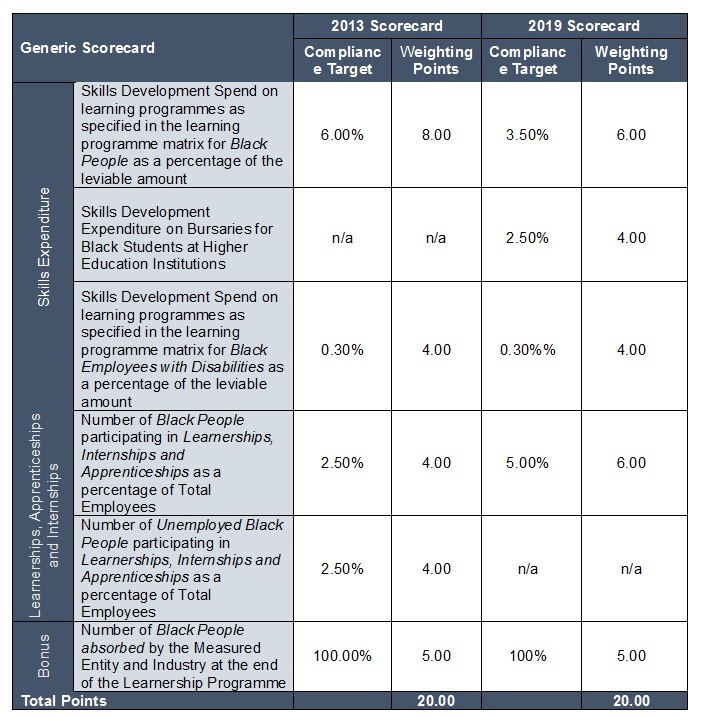

The table below shows the differences between the current amendments to the Skills Scorecard against the prior Skills Scorecard:

NOTES ON STATEMENT 400 – GENERAL PRINCIPLES FOR MEASURING ENTERPISE AND SUPPLIER DEVELOPMENT

In recognition that a properly executed ESD strategy may result in ED and/or SD beneficiaries no longer remaining EMEs and/or QSEs, the amendments to the Statement 400 allow for a measured entity to continue to recognise its suppliers who are 51% Black owned or 51% Black Woman owned in one instance and those that a qualifying ESD beneficiaries to be recognised as EMEs or QSEs provided that they were initially EMEs or QSEs when the measured entity first provided support to them.

The amendments to Statement 400 are effective from 1 December 2019 (6 months from, the date of the Gazette).

- Priority Indicator - ESD remains a priority indicator however with the amendment to the total points on ESD, the subminimum for each sub-indicator have been amended to at least 10.8 points for preferential procurement, whilst supplier development and enterprise development remain unchanged at 4 points and 2 points respectively. Failure by a measured entity to meet each one of the sub-indicator subminimum points will result in a measured entity being discounted by a level on its overall scorecard;

- Empowering Supplier Provisions – these provisions are included in the amendments, however, there is no clarity from the Dti as to whether or not they are now effective, i.e. there is no clarity as to whether the automatic recognition of the Empowering Supplier Status recognition applies to all enterprises regardless of size as per Notice 444 of 2015 (gazette 38799) or if the provision only applies to EME’s and QSEs.

- Enhanced Recognition on supplier spend remains unchanged, i.e. –for spend with the following suppliers, a measured entity may multiply its spend with the supplier by a factor of 1.2 in each of the following instances:

- The supplier is a qualifying supplier development beneficiary and has a minimum 3 year procurement contract with the measured entity, or

- The supplier is not a supplier development beneficiary, but has a has a minimum 3 year procurement contract with the measured entity, or

- The supplier is 51% Black owned or 51% Black woman owned on a flow through basis.

- Where procured goods and services are recognised under Preferential Procurement, they cannot be double counted under Supplier Development or Enterprise Development and similarly, if this expenditure is recognised under Supplier Development or Enterprise Development, it cannot be recognised under Preferential Procurement;

- Supplier Development and Enterprise Development Beneficiaries must be 51% Black owned or 51% Black Women Owned on a flow through basis.

- Procurement from 51% Black Owned or 51% Black Woman Owned Suppliers (measured using the Flow-Through Principle);

- Procurement spend with a qualifying enterprise or supplier development beneficiary will be recognised as if it were with a QSE or EME spend even in instances where the supplier graduates to a generic entity for a maximum of 5 years from the first time that the measured entity provided support to the supplier.

- Procurement spend with a generic supplier may be included in the expenditure for EMEs and QSEs where that such supplier had initially been an EME or QSE when the measured entity first procured goods and/or services from it, and the measured entity will only be allowed to recognise such supplier as an EME or QSE for a maximum of 5 years from the first period of procurement.

- Amendment to the benefit factor matrix in respect of guarantees – under the Loans and related contributions, guarantees provided on behalf of a beneficiary entity can be recognised at 50% of the guaranteed amount as opposed to the prior 3% per the 2013 gazette.

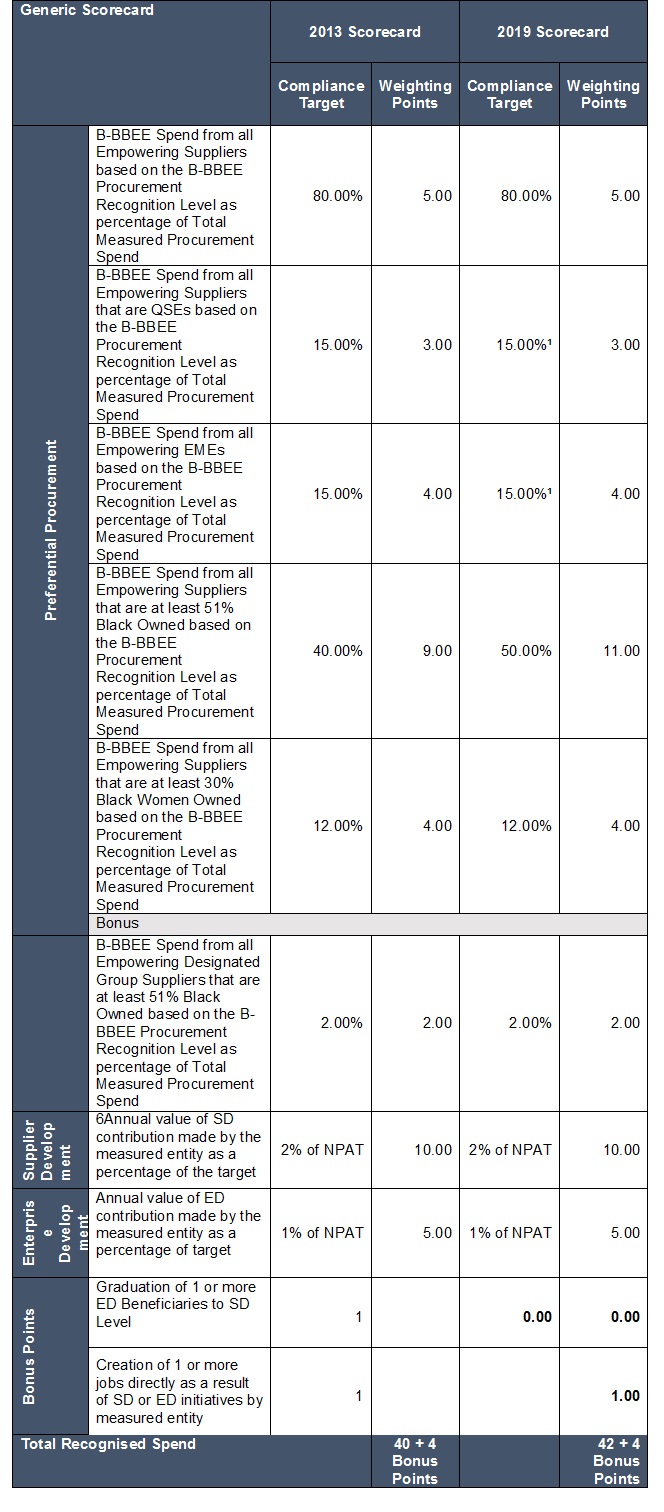

The table below shows the differences between the current amendments to the ESD Scorecard against the prior ESD Scorecard:

¹Where the measured entity procures goods and/or services from a 51% Black owned or 51% Black Woman owned generic supplier (using the FTP), that supplier’s spend may be included in the expenditure for EMEs and QSEs provided that such supplier had initially been an EME or QSE when the measured entity first procured goods and/or services from it, and the measured entity will only be allowed to recognise such supplier as an EME or QSE for a maximum of 5 years from the first period of procurement.

SCHEDULE 1: DEFINITIONS

The amendments to Schedule 1 are effective from 1 December 2019 (6 months from, the date of the Gazette).

The following have been added to the definitions in Schedule 1 of the Amended Codes:

Absorption - means a measure of the Measured Entity’s ability to successfully secure a long-term contract of employment for the Employee, Learner, Intern or Apprentice. [or to assist the Learner’s proceed with further education and training]

Designated Group Supplier - means a supplier to the Measured Entity that is at least 51% owned by one or more of the following categories of ownership within its structure:

- Unemployed Black people not attending and not required by law to attend an educational institution and not awaiting admission to an educational institution;

- Black people who are youth as defined in the National Youth Commission Act of 1996;

- Black people who are persons with disabilities as defined in the Code of Good Practice on employment of people with disabilities issued under the Employment Equity Act;

- Black people living in rural and under developed areas;

- Black military veterans who qualifies to be called a military veteran in terms of the Military Veterans Act 18 of 2011;

Long-term contract of employment - means a legal agreement between an individual and an entity that this individual would work for until his or her mandatory date of retirement;

Current Equity Interest Date - means the later occurring of the date of commencement of statement 100 and the date upon which the transaction undertaken by the Measured Entity in order to achieve black rights of ownership, became effective and unconditional;